News + Views From The Nonprofit World

Articles About Arts and Culture

Charity

Why Does the Historic Tax Credit Matter?

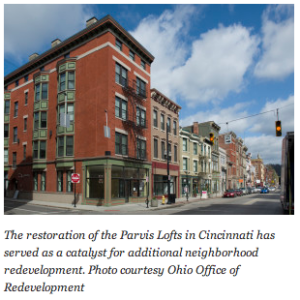

Source: National Trust for Historic Preservation As congressional tax reform efforts take shape on Capitol Hill, advocates of the federal historic tax credit would do…

Read ArticleActress Amber Zion Selected to Bring the Beauty of American Sign Language to Super Bowl Sunday

Source: The National Association of the Deaf NEW YORK, January 21, 2014 – The National Association of the Deaf (NAD) and PepsiCo announced today that after an extensive search actress Amber Zion…

Read ArticleAmnesty International’s Iconic Human Rights Concert Series to Return February 5th

Source: Amnesty International USA The Flaming Lips, Imagine Dragons, Ms. Lauryn Hill, Tegan and Sara, The Fray, Cold War Kids, Colbie Caillat and Cake among…

Read ArticleFellowship of Christian Athletes: What is Legacy?

Year-in and year-out, America’s Charities raises and distributes more than $35 million for America’s best, most respected 501(c)3 charities because individuals like you donate through…

Read ArticleNative American Rights Fund 40th Anniversary Powwow Grand Entry & Invocation

Year-in and year-out, America’s Charities raises and distributes more than $35 million for America’s best, most respected 501(c)3 charities because individuals like you donate through…

Read Article“The Indian Wars Never Ended”-NARF PSA

Year-in and year-out, America’s Charities raises and distributes more than $35 million for America’s best, most respected 501(c)3 charities because individuals like you donate through…

Read ArticleFeatured Charity: WAMU 88.5 American University Radio

In today’s media climate, news coverage from public radio stations like WAMU 88.5 is increasingly difficult to find. But, WAMU 88.5 is more than just…

Read Article- « Previous

- 1

- …

- 3

- 4

- 5